This is a detailed feature on the current Supply Chain & Shipping situation for Architecture & Construction projects – how the crisis works, present conditions, delays you can expect, & what to do.

Hello everyone, it’s early May 2022. I have a detailed update focused on the Supply Chain and Shipping situation, and how these are impacting Architecture & Construction projects.

This is a two-part release – next week I have a Part 2 covering Inflation & Rising Prices, potential Real Estate Stagflation, plus Current & Future Impacts on the Architecture & Construction Industry.

For a quick background, read these two pieces from earlier this year:

We raised four areas where we see challenges this year:

- Rising Inflation – We predicted rising inflation, resulting in increased costs for Construction, and shipping costs, plus additional costs for Supply Chain delays.

- Supply Chain – we predicted the ultimate effect of the supply chain is two-fold – one is unreliability in shipping assessments, and two is longer construction costs.

- Stagnating Real Estate and Property Prices – We discussed how a booming real estate market in late 2021 to early 2022, would conclude with stagnating real estate and property prices, as demand slows in 2022.

- Rising Interest Rates – we hypothesized new construction may slow down as interest rates rise, and that we’re likely to see a slowdown in new projects in late 2022.

It’s been a few months, so let’s see how things are unfolding. I’m going to start with Supply Chain this time, since that topic is particularly interesting…

Supply Chain & Shipping Crisis

Complicated situations have evolved on all projects – often for multiple trades on your entire project – – due to supply chain delays and shortages.

These are affecting vendors at every stage in their process, from procurement of raw materials from suppliers, to delivery of finished product. The delays are unpredictable in advance – every manager should be prepared for unforeseen delays that could affect the entire completion schedule.

Case Study in New York

A large office floor expansion I started in June 2021, entered construction in September. Construction was to end late March 2022, but we were forced to delay the move-in to early-mid May. There were two concurrent issues, simultaneously, impacting us, starting in January 2022.

First, with carpets:

- The carpet manufacturer (based in Pennsylvania) didn’t have raw materials for our carpet on time, a special silk fabric delayed from their own supplier who did not have it in stock, awaiting the next delivery (also disrupted).

- We did get the carpet delivered delayed in late February, only to find out the glue was improperly applied – the entire order had to be remade. A new batch was delivered in mid-April, extremely late.

Next, the core furniture order:

- The order was placed in September and due to ship from China in January, which was amid a new wave of lockdowns.

- Our product was completed on time, but our product shipment was delayed two weeks due to a lack of available containers.

- Once on the way – we learned the shipments were sent on two separate boats in February, and were due to arrive separately a week and a half apart.

- The arrival dates were then delayed from late February to mid-late April, lacking docking berths at the port of New York City.

- The first shipment was delivered on time;

- The second shipment was still on water, awaiting berth space, on the planned site delivery date of April 19. We finally received it on April 27 – over two months delayed.

This shows the complexity of the supply chain. By the time these concurrent issues resolved, our move in delayed from mid-late March 2022, to mid May 2022. As I write this in May, our project is still under construction.

There were four different points of failure:

- Having raw materials available to producers, as well as their own suppliers.

- After Completing the manufacturing on time, Having a shipping container available to load into.

- Once transported to the port site, having a ship (and dock space) available to berth onto.

- After extremely long transit times, it was having a dock and berth available to unload.

In the end, for our project, the first and final points are where two separate trades failed, causing major concurrent delays on the entire project. We faced approximately 1.5 months of delay on our project completion, on an original 5 month construction schedule. That’s a 30% increase in the schedule!

Impact on Shipping

The supply chain and shipping crisis is complex to understand – delays occurs at several different points, and your shipment can be affected at any one of these points (sometimes even multiple points).

- First is with availability of containers, as the shipment needs to be readied, but may be stuck awaiting a container to load into (keep in mind, a ship moored offshore with cargo, reduces the circulation of available containers).

- Sometimes shipments will be split into multiple units, and the two shipments may be separated including for shipment, based on availability of containers.

- Next is with movement of the units themselves, impacted on both the origin and destination side. First and last is movement between the ports & point of manufacture, and origin/destination warehouses.

- On the origin side, the shipment in container, needs to be loaded onto ship – which are often stuck awaiting space availability in port, as well as for boats to dock which are moored offshore.

- Once loaded often after much delay, the ships face a similar issue on the destination side, with ports too congested to accept cargo while they wait to clear their own backlog of inbound and outbound ships.

- During this entire process, the circulation of empty shipping crates is severely impacted, as the crates are in use for longer and longer dwell times.

The shipping chain issues are cyclical, which dramatically increases severity. It will take at least one year uninterrupted, if not longer, to truly reverse the situation, if we started today. Thus, we expect impact on projects through the next year.

With current political conditions, including a major world conflict in Eastern Europe, it seems that this situation is unlikely to get better soon. Management of the situation becomes ever more important.

Spring 2022 Chinese COVID Lockdowns & Port Closures

Since early April 2022, the city of Shanghai, China has been largely shut down, with major disruptions to work, and restricted freedom of movement. China, a major worldwide producer and supplier especially to the United States, has seen waves of shipments delayed and deferred in both directions.

- Due to the lockdowns, workers are unable to commute to work as port operators as well as manufacturers, and also for transport. The available capacity of all systems has reduced while demand is meant to fill previous orders.

- The port of Shanghai has remained in operation through the lockdown.

- Our first link from May 1, sourced from Freightwaves.com, states “wait times for export loadings are only about two days and the 12 days it takes to pick up an import box is below wait times for other COVID-related disruptions in China since 2020, as American Shipper reported Thursday. The daily number of vessels waiting for a berth has actually fallen since the lockdown began nearly four weeks ago and there is limited congestion from redirected cargo at other ports.”1 In other words, operations have improved.

- This is misleading, as the measurements of current throughput don’t account for the deferred cargo piling up in warehouses, or for scheduled production working overtime to make up for lost time. “The vast majority of truck drivers are restricted from freely moving around Shanghai and making deliveries at marine terminals.”

- “The slowdown in imports has prevented key raw materials from reaching manufacturers and many companies have either shut down or are operating at severely constrained levels.”

- The lockdown will continue for many more weeks, if not months longer. Freightwaves.com continues “There is no sign that Shanghai’s lockdown is easing anytime soon. Footage on social media shows steel fences being installed on public roads and inside residential compounds to keep people from traveling to other districts and moving in neighborhoods”

- A related Statista article notes the same – “With employees unable to go to work, the world’s largest container port is having to manage with significantly fewer staff.”2

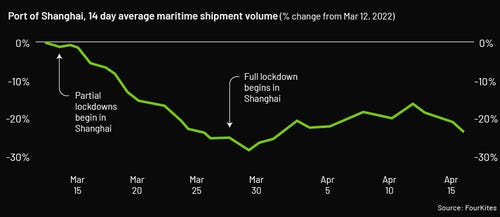

Here’s some data up thru April 18, 2022 on the % change from mid-March on the maritime shipment volume. As you can see, this is down visually averaging 20%, but sometimes as low as 30%.

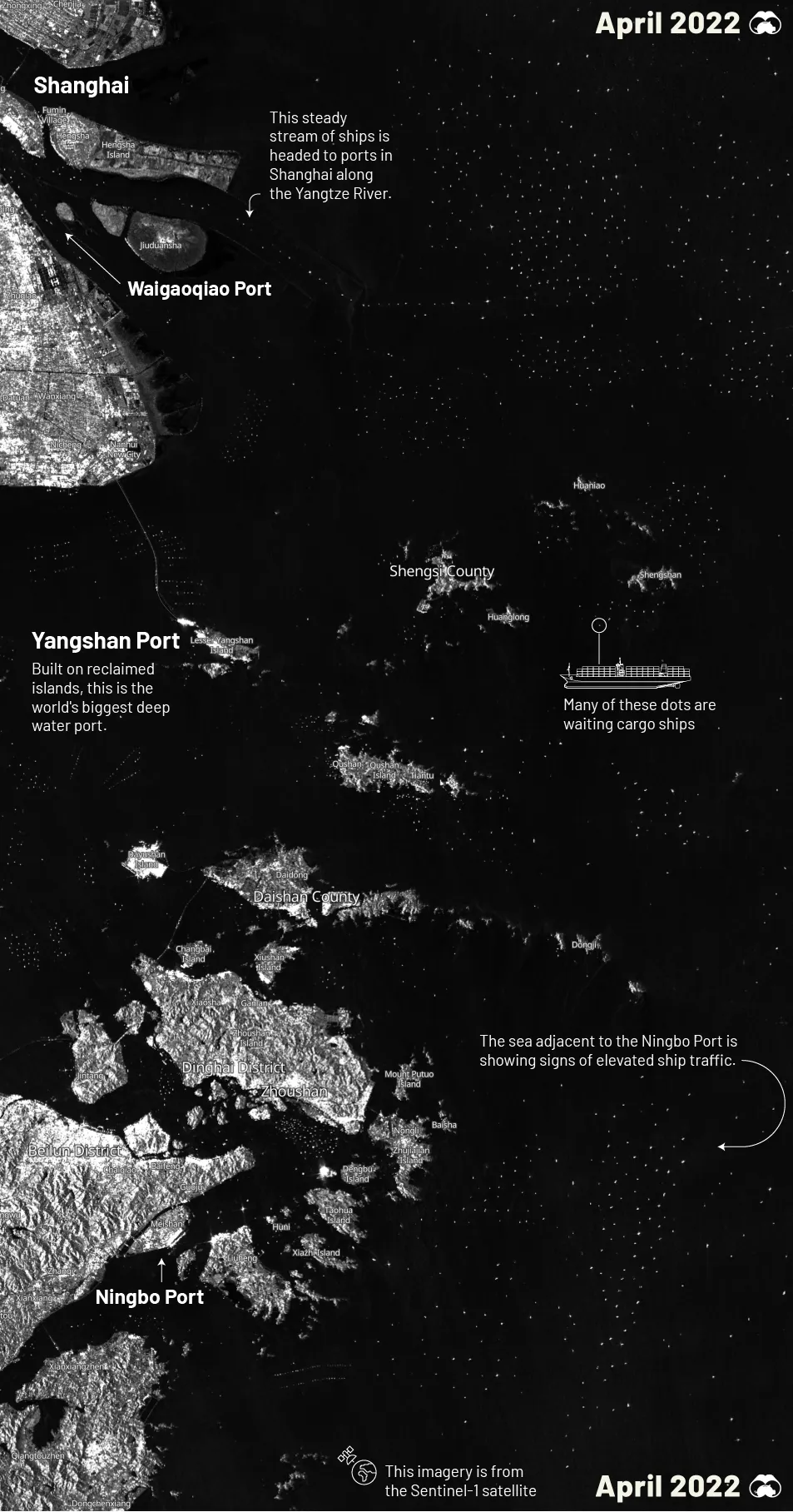

Map of Chinese Port Situation, April 2019 versus 2022 3

These two images below compare the visual density of ships around the Shanghai ports, a couple of years apart. As you can see, in April 2022 the situation is seriously congested, with many ships idling simply waiting for availability to berth and load/unload.

Here’s a Statista provided live view from April 28, 2022 4 – with large clusters of ships moored/anchored awaiting clearance to the ports.

“The number of container vessels waiting outside of Chinese ports today is 195% higher than it was in February. – WINDWARD”

Upcoming Summer Supply Chain Crisis

Once Asian ports reopen and allow shipping again, there will be a massive wave of container ships making their way from Asia to many destinations in the United States. The current logistics shutdowns will also result in a flood of deferred cargo being released all at the same time, once everything reopens – and thus, a massive demand for empty containers.

This process hasn’t even started yet, so it can’t even begin to be factored into the data. However, just consider that based on the data above, volumes have been reduced for 25-30% for a month, while demand has stayed stable and orders continue to stack. Once production reopens, the outbound volume from China across the Pacific will be massive – all arriving at already capacity constrained ports in the United States.

The queues that we see outside Shanghai will likely show up at all ports in North America by July 2022, I expect the ripple effects of this wave to create the same type of situation in North America affecting us from Summer through Winter 2022-23. The situation can be expected to worsen – with major delays to both raw material as well as completed product, all relying on the same systems for transport.

All ports are at this moment still facing severe capacity issues, with large queues waiting to berth; soon, there will be many more ships offshore and unable to dock to unload.

Unpredictable worsening delays to the supply chain for internationally sourced items (including commodities and raw materials), means project schedules will continue to lengthen due to lack of materials. Projects will continue to have longer schedules and be more expensive overall. This is an unavoidable and unpredictable outcome – creating impacts on all projects.

I strongly recommend that readers and viewers pursue professionals to manage their projects, in light of such developments. Additionally, budget additional time and cost expectations during the course of the following year – this has become ever more important to manage, especially sequencing move-ins.

Plan for an additional 20-30% extension in your schedule (typically 1-4 months). Be flexible with your furniture delivery dates – I even suggest booking several freight elevator dates in advance, just in case!

Late 2022 and Early 2023 Slowdown

With Rising Prices and Rising Inflation causing Stagflation effects in the market (a pullback of investment in projects and work), it can be expected that shipping will also eventually experience a slowdown. I’ve already started to see Owners and Investors pull back work; so far it’s just been optional work, but all work was scrapped once they saw the prices. The price increases in construction are shocking.

We’ll discuss all of this in Part 2, next week.

In Part 2 of this feature, we cover the impacts of:

- Rising Inflation

- Rising Prices

- Rising Interest Rates

- Stagnating Real Estate and Property Prices

- Current Demand for Vendors in the Architecture and Construction space.

I have many tables, charts and much data to share.

We’ll also assess the real, predicted impacts to Architecture and Construction projects into 2023, and how we see things unfolding. Stay tuned for the next release next week!

- 1. https://www.zerohedge.com/markets/crisis-or-hiccup-assessing-logistics-impact-china-lockdowns; May 1, 2022

- 2. https://www.zerohedge.com/economics/shanghai-ship-jam-spells-supply-chain-trouble; May 1, 2022

- 3. https://www.zerohedge.com/economics/satellite-maps-expose-shanghais-supply-chain-standstill; April 21, 2022

- <img src="https://arcobee.com/wp-content/uploads/2023/11/1212.png" alt="" width="60%" class="alignnone" />

- <img src="https://arcobee.com/wp-content/uploads/2023/11/1313.png" alt="" width="60%" class="alignnone" />

- as American Shipper reported Thursday

- 1

- container

- 2

- 3

- 4

- https://www.zerohedge.com/markets/crisis-or-hiccup-assessing-logistics-impact-china-lockdowns

- https://www.zerohedge.com/economics/shanghai-ship-jam-spells-supply-chain-trouble

- https://www.zerohedge.com/economics/satellite-maps-expose-shanghais-supply-chain-standstill

- https://www.statista.com/chart/27343/container-ship-backlog-off-shanghai-port/

Table Of Contents

Table Of Contents

Leave a Reply