Hard, raw data on rising prices & inflation in construction, plus upcoming stagflation – and the situation for Architecture & Construction projects.

Here’s our second update on the mid-year impacts to Architecture & Construction projects. Read Part 1 here – where we discuss the Supply Chain and Shipping Crisis.

In Part 2, I cover Rising Prices, Inflation, and Real Estate Stagflation. I review many bits of hard data we’re seeing today in the industry over rising inflation, price increases, and current rising interest rates that are impacting the market. I discuss impacts to Architecture & Construction projects in much more detail at the end of this article, & where it’s expected to go into next year.

In light of recent developments that are unfolding since two weeks ago, I’m also going to feature a Part 3 piece covering diesel fuel scarcity and rising fuel costs situation that is rapidly unfolding especially in the United States, which I anticipate will also create ripple effects across the industry.

Inflation

The supply chain crisis is creating a massive ripple effect with inflation, creating rising prices and costs for construction. Inflation is to the tune of 5-12% per month at times. This is in turn creating a stagflationary environment – where the cost of desired work is too much to engage in, thereby reducing both project scope, as well as the volume of projects for the industry.

Rising Prices

In early April, I heard from one of the lead estimators in a construction firm I worked with –

“ We are receiving calls now everyday from suppliers. <An office fronts vendor> just called me saying the aluminum and glass for their office fronts is going up 12% due to their suppliers increasing their pricing for raw materials. Right now certain items are extremely volatile.”

He forwarded two messages from different subcontractors – here’s one dating to March 2022:

“This is to notify you that due the economic impacts of the Covid-19 pandemic leading among other things to shortages in raw materials, and increased labor costs, over the past two years the prices on the following items have increased as follows:

- Black Fittings 65%

- Black Pipe 110%

- Copper Pipe 100%

- Copper Fittings 100%

- Grooved Pipe 45%

- Grooved Fittings 40%

- No Hub Pipe/Fittings 25%”

And from another subcontractor, whom, the latest in March 2022:

“We have received notification from all domestic steel pipe manufacturers of an approximate 12% increase on all fire sprinkler pipe effective immediately”

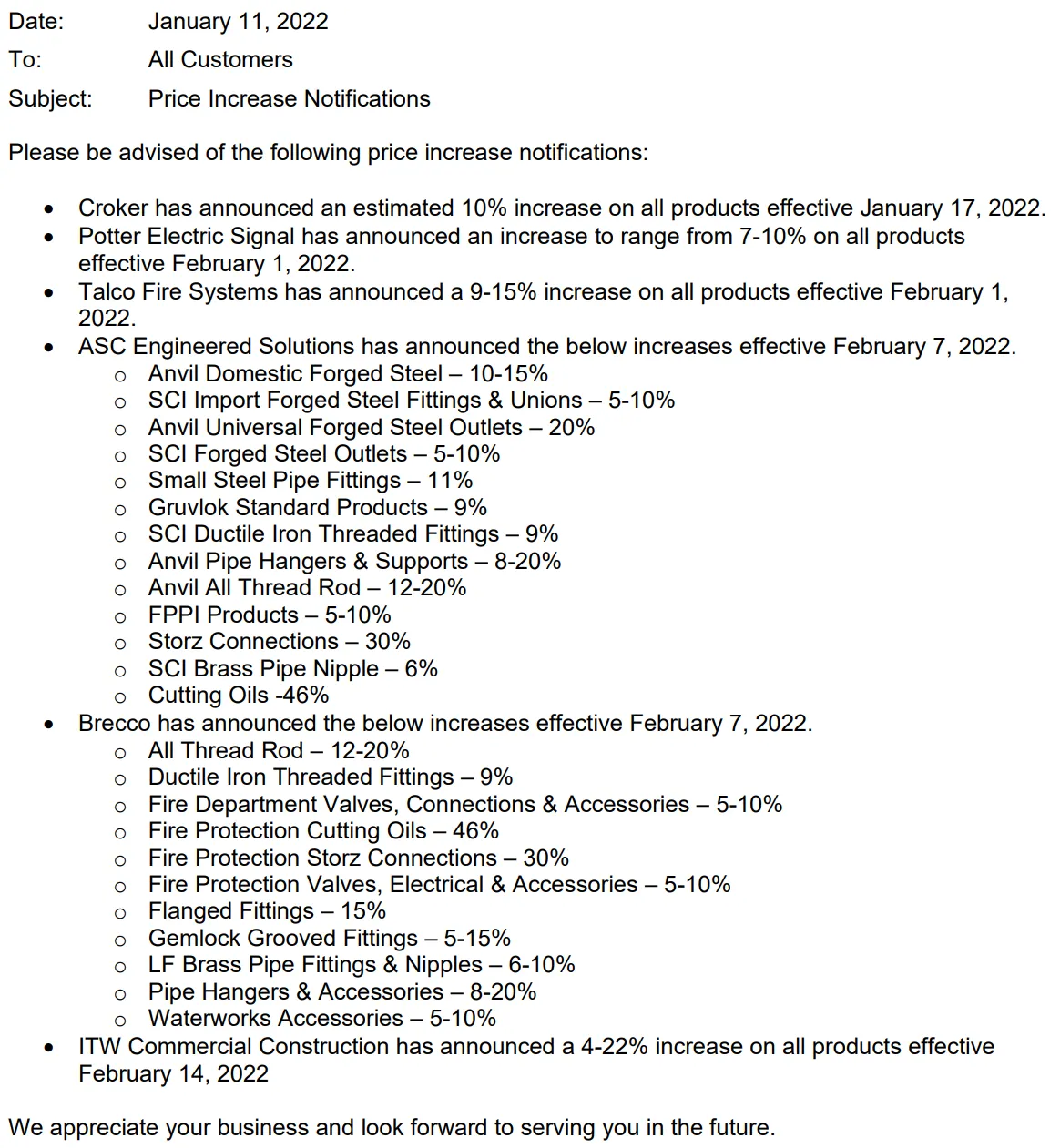

Here’s an image from a January, 2022 notice. The estimator graciously forwarded me 43 notifications of price increases since March 2020.

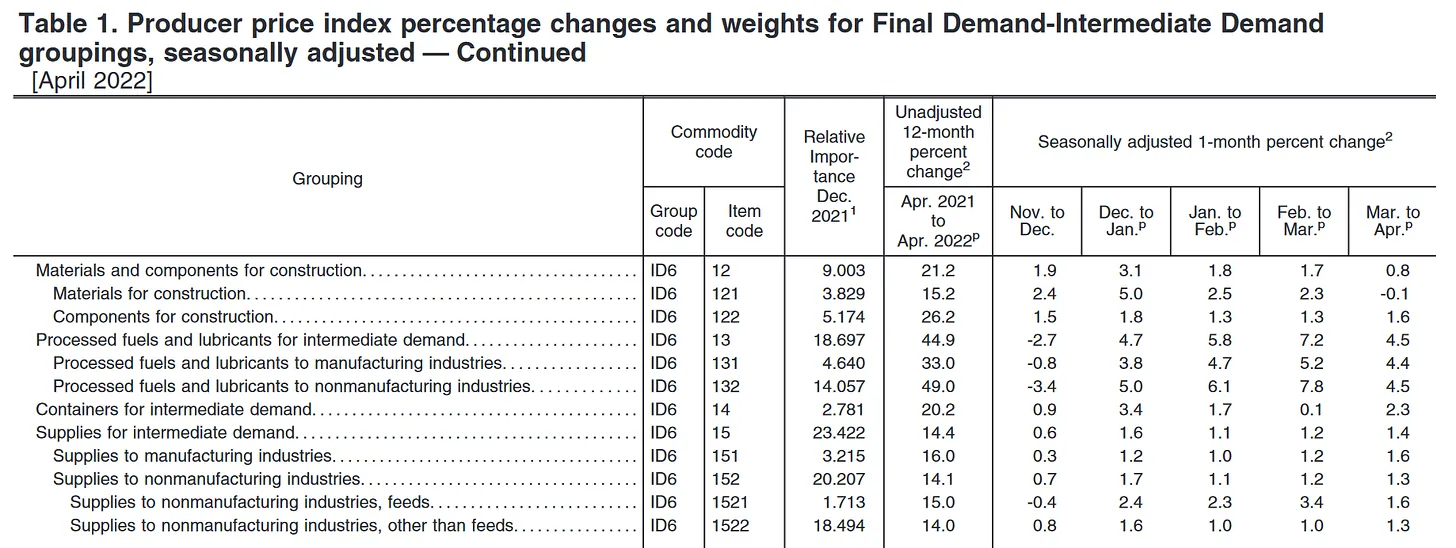

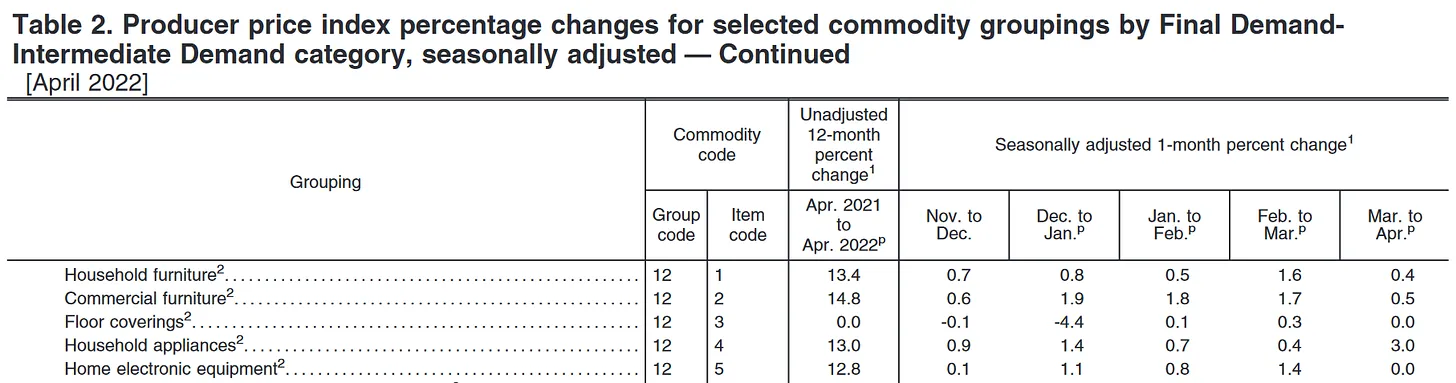

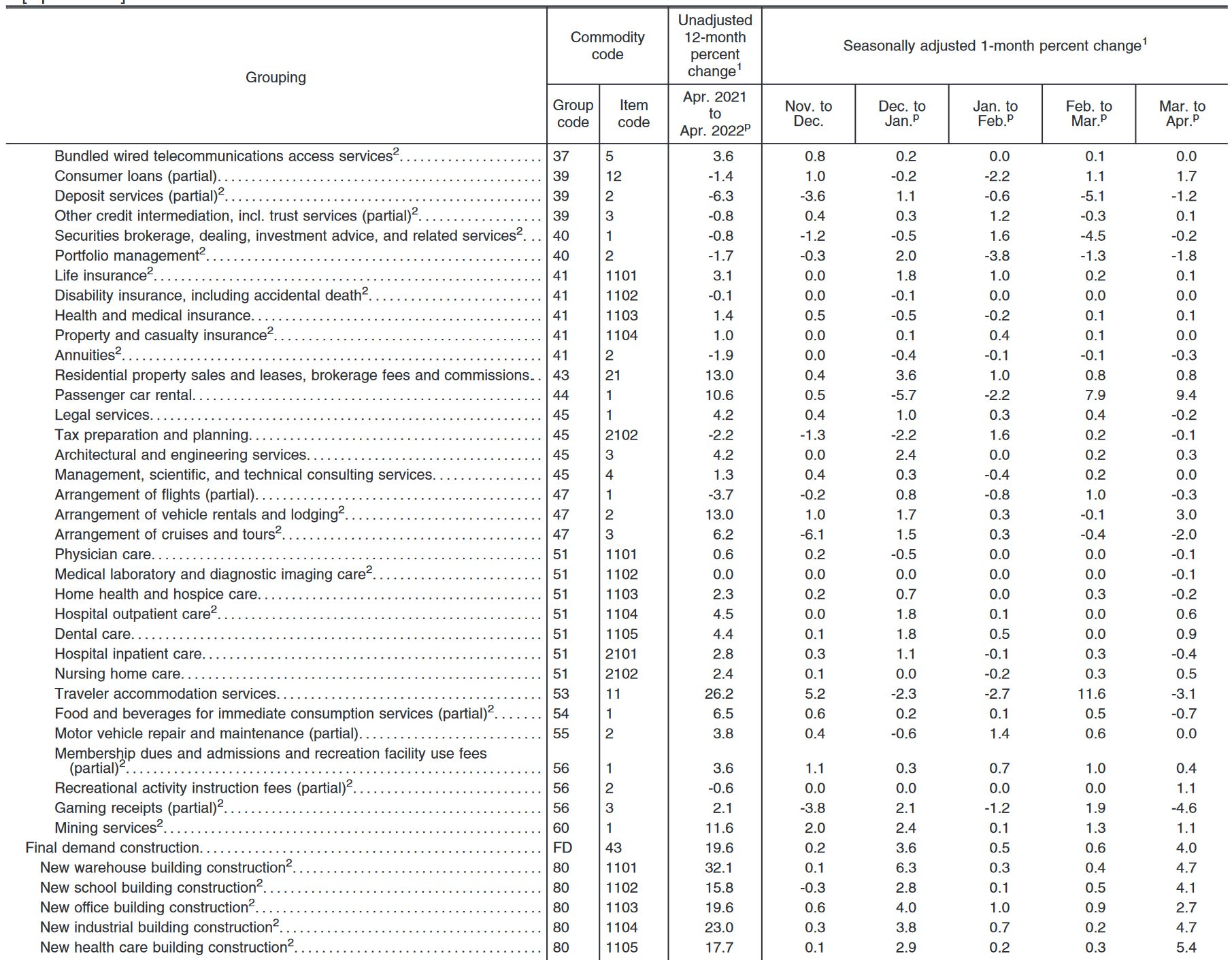

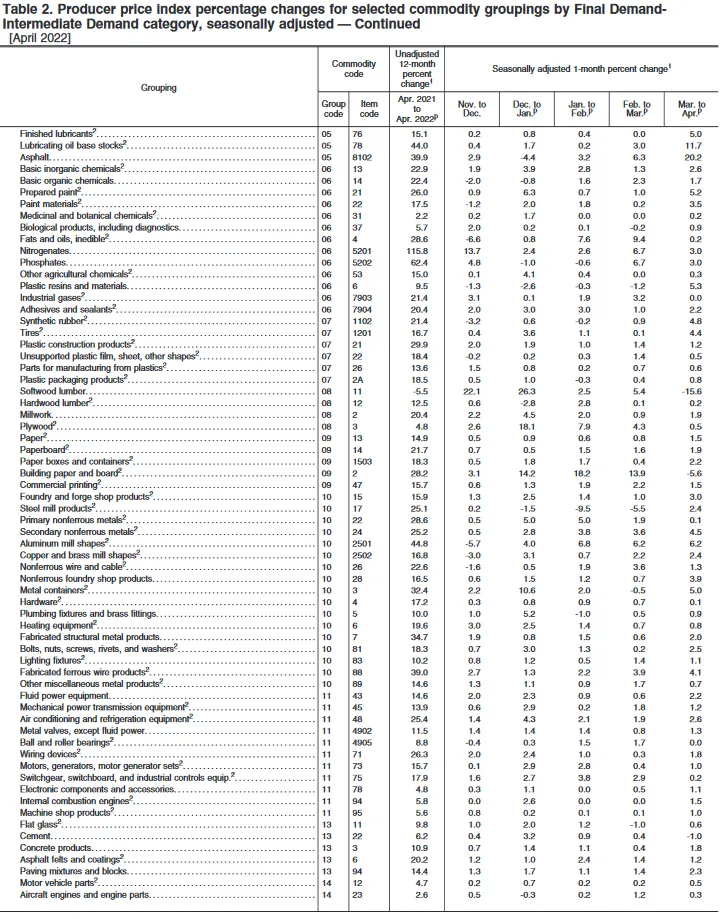

The latest April 2022 American PPI report also paint a worrisome picture. Here are some snapshots from the Producer Price Indexes on the April 13, 2022 Bureau of Labor Statistics’ report.1 Look at “unadjusted 12-month percent change” between March 2021 to 2022.

First, on page 15:

Materials and components for construction saw a 21% increase over one year. Materials increased 15.2%, and components increased 26.2%. Also notable is a ~15% increase in cost of supplies, and a 20% increase in container costs.

Next on Page 20:

Furniture costs increased ~14%, and appliances 13%. Electronics also see an approximately 13% increase.

We can see that new building costs have risen almost 20% on average, to a staggering 32.1% in the industrial sector! Architectural and Engineering Professional Services have seen only a 5% increase in pricing.

On page 22, the PPI report covers raw materials – we can see that on average, costs have increased for construction items 20% YoY, whereas some products have further increased in price as high as 40%!

Due to the combined delays of shipping, and increasing cost of raw materials, the effects of inflation are expected to worsen. I think this will cause a further pull back in investments into property, with much work deemed too expensive to pursue.

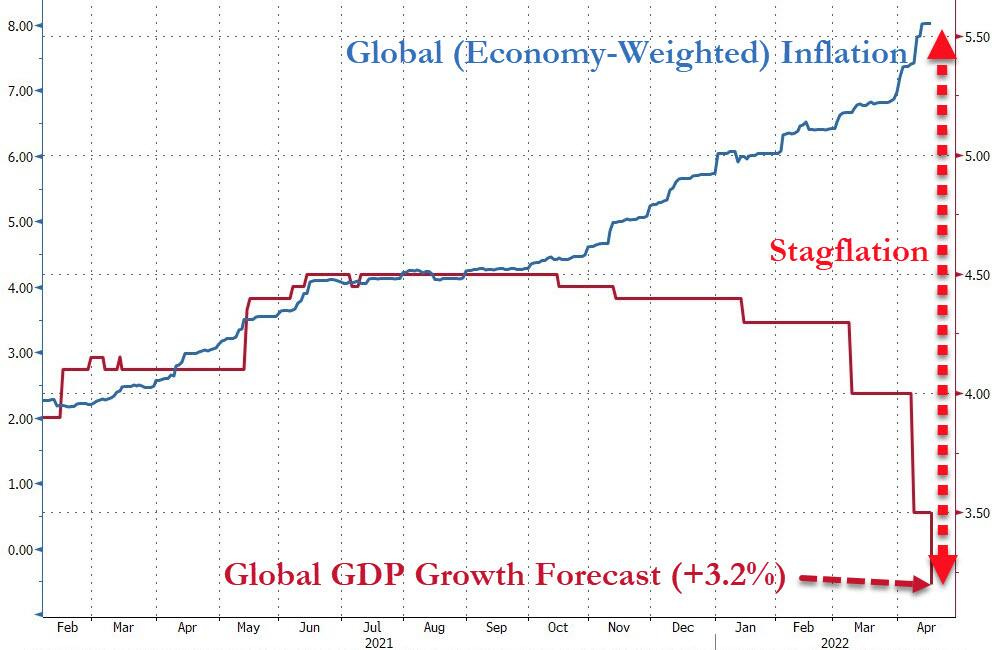

Inflation Leading to Stagflation?

Many economists have recently and since 2021 been worried that global inflation will continuing to soar and growth severely waning, creating stagflation anxiety. This chart conveys how Inflation creates Stagflation.

An article also featured on ZeroHedge, from the world’s largest shipping company, also covers a fear from global shippers of a drop in shipping demand due to inflation.2

“We clearly see inflation, and I don’t think it’s temporary.

“There are quite a number of factors that suggest we will see less growth in the second half and into next year,” Skou said, indicating a drop in Chinese export orders and slumping confidence and business confidence in the US and Europe.

For now, the boom in construction that began in 2021, continued very strongly through winter and spring, 2022. There are also many projects lining up to start construction in September or October, to be completed by early next year. Thus, professionals and businesses continue to experience an extraordinary workload and struggle to keep up.

I have, however, noticed more clients decline work that is deemed optional, and in general there is a trend to pull back on discretionary spending. Most notably, it appears many Owners are limiting their scope on a project or turning down work deemed too expensive to pursue, as a means to keep costs lower.

For example, a client just finished a landlord build overlooking Central Park in East Manhattan, and didn’t like the baseboards installed – a standard commercial grade vinyl baseboard. For weeks they were clamoring to replace these with a standard, simple 4” painted wood baseboard – and only in three rooms – the Small and Large Conference Rooms, and the small entry lobby. For this scope of work, the quote we received was $17,900 – a price which was negotiated twice with the subcontractor and included heavy discounting on contractor fees. A year ago, such work might have been only $12,000 – 13,000, a far more reasonable price.

Our client opted not to engage in the work, deeming it too expensive.

I expect this sort of pattern to continue as the year carries on and both prices and interest rates continue to rise – which ultimately translates to lost opportunity for businesses and owners alike.

Rising Interest Rates

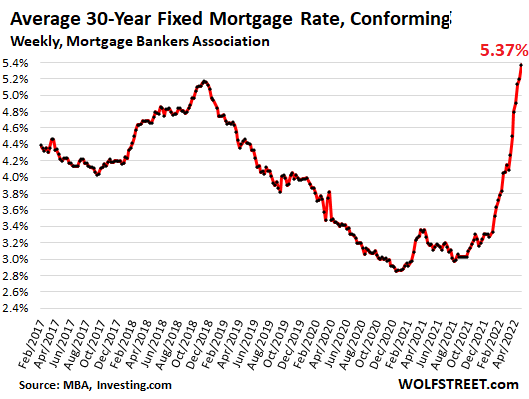

In addition to inflation, further rising interest rates are due in this year. On May 4, the Fed announced the beginning of quantitative tightening on June 1, capped initially at $47.5BN and growing to $95BN. This is the first of several cycles to be launched prior to year end.

We first expected that economic growth and recovery would slow as interest rates rise. For now, it’s too soon to tell whether this will be so at least in the construction industry – the combination of the three above items have been enough that all projects longer, more expensive and more complicated, but this has simultaneously translated into more Architecture & Construction work this year.

I suspect that in the medium to long term, we’ll see rising inflation & rising interest rates slowing construction workflow.

Stagnating Real Estate and Property Prices

We’ve just begun to see the impact of inflation and credit on the real estate market. During the pandemic years the real estate market flourished, with mass relocations throughout the country and investments in housing. This trend appears to be slowing, maybe even reversing.

I have reports from friends that are quitting the mortgage business in scores, as rising interest rates have dramatically slowed home sales. My friend in Ohio, who works in the business part time, remarks:

“mortgage rates are up and all my friends are quitting or have quit…business has slowed.”

A relevant article from Peter Schiff3 on the web, confirms the situation:

“As mortgage rates push up, mortgage applications continue to fall. As of last week, applications were down 17%, and at the lowest level since May 2020 when the economy was shut down for COVID, according to last week’s Mortgage Bankers Association’s weekly Purchase Index. The index has dropped 30% from peak demand in late 2020 and early 2021.”

this article also includes interesting data showing how much housing costs have skyrocketed in the last year:

The mortgage on a home purchased a year ago at the median price (per National Association of Realtors) of $326,300, and financed with 20% down over 30 years, at the average rate at the time of 3.17%, came with a payment of 1,320 per month. The mortgage on a home purchased today at the median price of $375,300, and financed with 20% down, at 5.37% comes with a payment of $1,990.”4

In other words, buying the same house today will cost you $670 per month more than it did if you bought it last year. That represents a 50% jump in mortgage payments for the same home

With the Fed’s upcoming interest rate hikes, the real estate market is likely to stagnate. I predict a full impact will occur in Winter/Spring 2023, rather than late this year – although the current issues will certainly continue to worsen.

Some believe this may crash the real estate market. I think this is to be determined – in places like New York, the demand for rental housing is still sky high. A conflict brewing in Europe is causing an influx of capital into American real estate as safe harbor in the US Dollar – potentially a boon if home prices decline.

The real estate market is one to watch; the current trend does point generally negative, but this sector may benefit with increased capital flow. Thus, the construction industry will for now continue to thrive until mid to late 2023. As that point I suspect it to feel the impact when investment broadly pulls back in the United States.

Predictions for Architecture & Construction Projects thru Summer 2023

The demand for Architecture & Construction projects continues very strongly, and will continue thru the end of the year into early next year. I still see today a tremendous interest in new projects – I believe that everyone is aiming to “get ahead” of rising inflation and rising prices, as much as they can. Overall the latest projects are smaller in scope, as well.

This is very good in the short term, but does not bode well in the medium to long term.

We strongly suggest raising project contingencies to 12-15%, instead of 10%. Rising prices have created chaotic, expensive markets – and shipping delays plus supply chain issues, will definitely worsen into the next year. It will get worse, before it gets better, unfortunately.

As for the professionals – you’re aware of a busy industry the past 9-10 months or so. I expect this to continue based on these trends, at least until Spring 2023. This is good news for us – with the increasing supply chain crisis and challenges in construction, the need for proficient project managers and professionals remains strong, and both Design Professionals and Construction firms see sky high demand utility.

Some of the highest demand vendors are:

- Landscape Architects & Builders

- Lighting Designers

- AV, IT, & Systems Designers (especially in the era of virtual meetings).

On the Construction Side, many trades continue to face significant challenges with materials:

- Appliances – both Permanent, & Temporary Appliances

- Carpet

- Lighting

- Stone

- HVAC Equipment

Worrying Situation Beyond November 2022

I am concerned about the situation in the industry facing us in Winter to Spring 2023 and beyond. The economic market is extremely volatile at the moment, with rising inflation and interest rates threatening stagflation. There are already signs above that we’ll see a pull-back in construction projects, simply because they’re not affordable. At the same time, there continues to be a boom at the present time while Owners try to beat inflation for their long term projects.

Unfortunately, rising costs also mean that Owners and Investors will be pulling back on scope in order to save costs, and supplemental work will often be deemed too expensive to be worth pursuing. Thus, professionals, vendors, and construction will see a slowdown after about 8-12 months time.

In Part 3, I’ll cover the impacts of Rising Diesel Fuel prices on the supply chain.

- 1. https://www.bls.gov/news.release/pdf/ppi.pdf

- 2. https://www.zerohedge.com/markets/worlds-largest-shipper-warns-about-stagflation-and-china-shutdowns

- 3. https://schiffgold.com/key-gold-news/has-the-fed-already-pricked-the-housing-bubble/

- 4. https://www.zerohedge.com/personal-finance/has-fed-already-pricked-housing-bubble

Table Of Contents

Table Of Contents

Leave a Reply