Every part of the construction commodities, production, and transportation chain is impacted by current rising energy costs. I share with you the hard data to date and what to expect into 2023.

Here’s our third, final update on mid-year impacts to Architecture & Construction projects.

In Part One, I covered the supply chain shipping crisis, driven by disruptions at multiple points along the production chain, plus international lockdowns and port closures. Once released, we’ll see a flood of production inventory pour into the shipping market, slowing down North American ports capacity.

In Part Two, I covered rising price inflation, supported by raw YoY data. I showed how these plus rising interest rates are creating high demand in the short term – new business is booming as investors pour money into projects now to beat future costlier investments. In the long term, demand destruction and stagflation is a major risk which will eventually impact us professionals in the industry.

Since the situation is changing so rapidly – unfortunately not in a good way – I’m providing my final update in Part Three. I focus on the rising costs of energy, and how this is shaping a diesel fuel cost and scarcity crisis in parts of North America. I discuss how the rising cost of energy is unfolding in real changes across the industry into the next year.

I hope that you’ve enjoyed our series to date – be sure to subscribe to read all the juicy details! We also have a trial option, if you’re not sure yet.

Understanding the Role of Energy

Energy thermodynamics are a core, physics driven order of our physical, natural world. Following the Laws of Thermodynamics and conservation of energy, energy can change forms but is never created nor destroyed. Matter can change forms, through “energy consumption” which is the controlled transfer of physical form. Carbon is one of the raw elements of our natural and built environment – and is found vigorously in our energy fuels (oil, natural gas, coal, etc..) which form the basis of this controlled transfer process. Energy is “consumed” when matter is converted into a form useful to tools and mechanical systems – typically gasses.

For instance, a diesel engine converts diesel fuel into exhaust gasses through little explosions that power pistons, crankshafts, and axles, and thus provide propulsion for the vehicle.

Every component and every single stage of production, manufacturing, transportation, installation and delivery involves energy consumption. Thus, every part of the supply chain is impacted by rising energy costs!

Every stage of a product cycle involves fuel consumption:

- Oil is refined into chemicals and petrochemicals, used all across the market.

- Polymers for resins in flooring (concrete flooring, terrazzo, etc) require special petrochemicals and fuels to produce.

- Other petrochemicals support materials, colors, and finishes used widely in Architecture projects.

- Special finishes (for instance, millwork and metals) require heat, mechanical tools, and fuel in order to produce correctly.

- Waterproofing, Glues and binding are all originally sourced from petrochemicals.

- Air Conditioners, HVAC and duct work systems are produced using metals and fuels.

- Fuel is required for steel and stair work, welding, pipes and other metals. Propane, natural gas is required as well on the production side.

- Last-mile deliveries to warehouses, and to/from project sites are done through trucks that consume diesel fuel; often, these trucks are also idling during deliveries and in transit.

- …you get the idea!

I hope this makes clear (for those that didn’t already know) how intermixed the raw cost of energy is connected directly to the hard costs of construction and property improvement.

Rising Diesel Fuel Costs

All materials, components and finished products are transported many, many times – at multiple different stages. A commodity transfers many times before being installed on a finished project. North American transport is typically by truck, sometimes by ship, with some rail/air intermixed.

The North American transportation system has since the early 1900s systemically moved away from electri and rail transport for short-distance freight – in conjunction with land use choices most industrial, production, and warehousing facilities only have auto and truck access, which are entirely dependent on petroleum fuels. Even trains in North America are diesel powered, unlike most of the rest of the world. Thus the transportation system is entirely dependent on petroleum fuel costs, and will also continue to be for at least one to two additional decades (keep in mind major generational changes in technology such as electric trucks still take many, many decades to see through as a fleet with network capabilities.

We all know now that fuel costs have rapidly risen since late last year, and the rise has recently accelerated especially for diesel fuel.

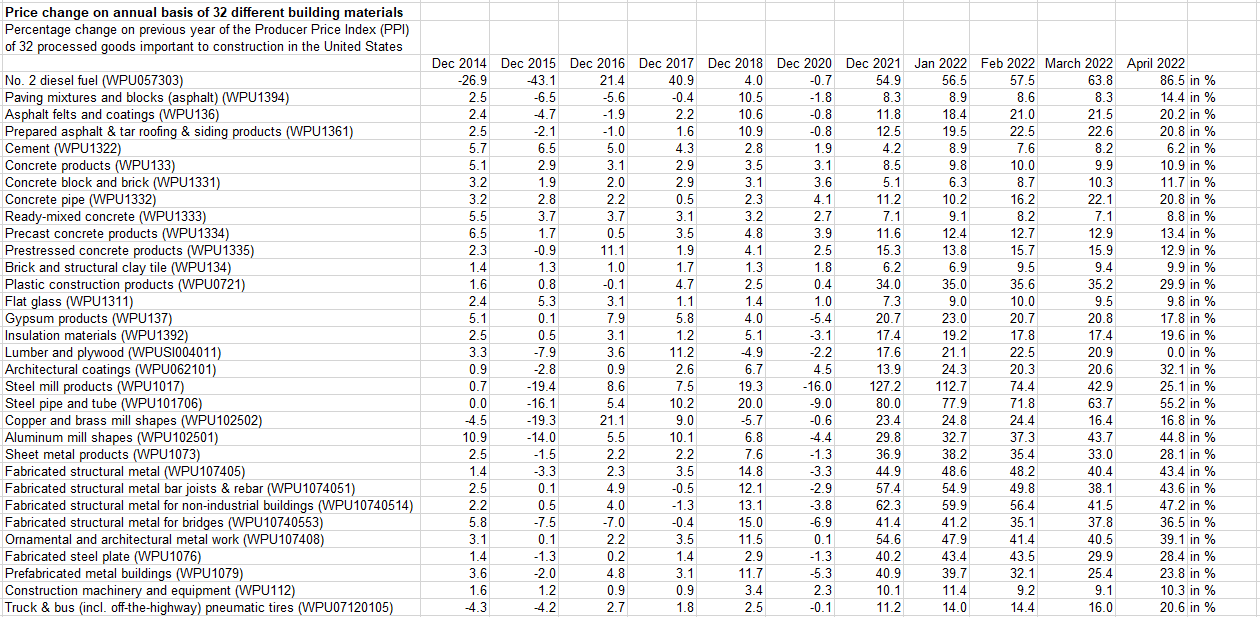

With some research, I found hard numbers for increases since the beginning of this year. Incredibly, we’re seeing 54% to 86.5% increase Month Over Month since the start of 2022!!1 I am confounded by the data, but it’s important to note that the chart, which goes as far back as 2013, has never shown such an increase in the cost of diesel fuel year over year, let alone month over month.

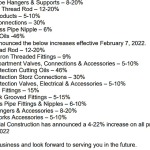

Here’s “No. 2 diesel fuel” shown as a % increase from preceding data.

I pulled out the data from Statista as an Excel data file:

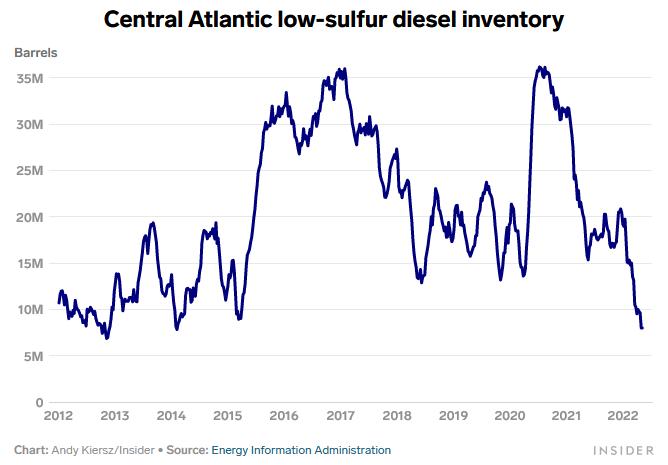

Media coverage from Business Insider2 paints the same picture:

Prices for the key fuel have surged roughly 75% over the last year as inventories have plummeted. US stockpiles for the most commonly used diesel have dropped 43% since 2022 to the lowest level since 2014.

In the Northeast things are even more dire. The average price for a gallon of diesel in New York state is $6.52, up 102% from a year ago.

Now ask yourself – has the transport, construction and materials market priced in a 100% YoY increase in the cost of diesel fuel? In my opinion, it’s already started but we haven’t seen the full, real impact. If the price hasn’t yet been reflected we’ll certainly see it before year’s end.

Rising Natural Gas Costs

Natural gas costs are also rising at an unprecedented rate – a huge story in the energy commodities markets. This new energy cycle began in mid to late 2020, and has picked up speed since 2021, particularly in February 2022 after the Ukraine-Russia crisis began.

Natural gas is a key energy source across markets, used in:

- Heating and as Heating Fuel

- Manufacturing

- Power generation

- Plastics

- Polymers and Fuels

- Jet fuel (for air transport and associated costs)

- Computer chips and technology production (used in Appliances, AV, IT, and Security Systems)

- Metalworks production

- Glass production.

Natural gas is now at its highest price over the last decade. This second Business Insider article3 from May 27th shares the big picture:

US natural gas prices briefly surpassed $9 per million British thermal units this week for the first time since 2008… up more than 180% from a year ago.

The slowdown in the US shale boom has weighed on natural gas production. Meanwhile, US exports of natural gas are booming as buyers in Europe and Asia have scrambled for additional supplies since Russia’s invasion of Ukraine sent global energy markets reeling.

Along with the natural-gas price jump – diesel, jet fuel, and prices at the pump have all surged.

The increases in natural gas costs are unsurprising in May 2022:

- During the pandemic crisis in 2020-2021 due to low demand, production was cut for domestic natural gas production.

- Demand has since surged into 2021-2022 with a massive wave of economic activity, including major investments in real estate and capital projects.

- The Ukraine-Russia conflict and associated sanctions have cut off many markets from their previous access to Russian natural gas supplies.

- American exports are taking their place – thus, the American Natural Gas export market is absolutely on fire.

- New production coming online is still limited, with many future leases cancelled and few scheduled to come online.

This incredible combination of events has created unprecedented demand for a shrinking supply pool – and thus, rapidly rising natural gas prices.

In my opinion it’s still too soon to see the real effects of this increase – but the main problem is how there’s really no possibility for reductions in the short term. I fully expect the cost of natural gas to continue increasing substantially this coming fall and winter. In May 2022 we’re currently entering the summer season, and thus there’s far less demand for natural gas for heating purposes. Once we hit October and November – and especially January and February – rising seasonal demand will coincide with still diminishing supply. There’s possibility for serious problems to emerge on the market from a combination of rising gas costs, again driven by limitation of inventory and sky-high demand!

Diesel Fuel Shortage Crisis

The pattern I described above with the natural gas markets, is also taking place with Diesel Fuel – and virtually with the exact same cause and effect.

Due to the same combination of factors…

- Decreased and static oil production since 2020 – and cancelled leases for new drilling and new oil production.

- Huge demand increases since 2021, especially as the post pandemic economy has emerged, with major construction works, investments, and resuming of productions.

- Massive demand in the export markets taking increasing parts of the demand pool – due to the Russia/Ukraine war and associated sanctions, American diesel exports are competing on the bidding frenzy environment for fuels supporting Europe.

…Diesel fuel supply is now dwindling quickly in 2022.

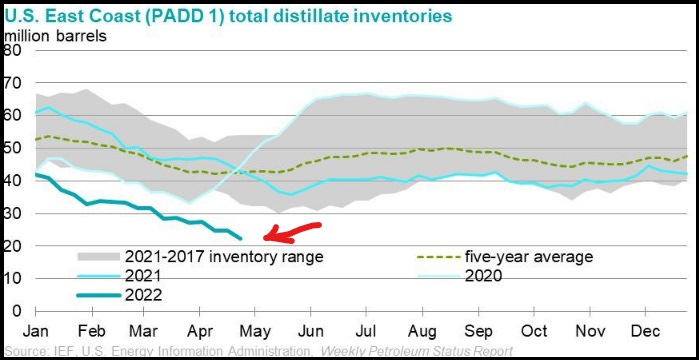

The fuel shortage has been observed most in the Northeast USA, highly unusual for this season:

- Traditionally in summer months diesel has been cheaper than gasoline.

- Diesel is also used as heating oil, which is not consumed in the summer.

- Summer is traditionally slower for truck deliveries, until fall and winter creates stocking for Thanksgiving and Christmas seasons.

The combined effect has been rising prices plus rapidly declining inventory.

As we can see here the inventory is reaching lows preciously seen in the early 2010’s; however, this time it’s exacerbated by sky high demand, including in the exports market, and little increases in production.

Impact of Rising Energy and Fuel Costs on Transportation

An Architecture and Construction project is comprised of its many different parts and pieces. Inevitably it is a gigantic assembly puzzle with many different components. Thus, increases and critical delays in the different components, will certainly impact the costing of the whole assembly.

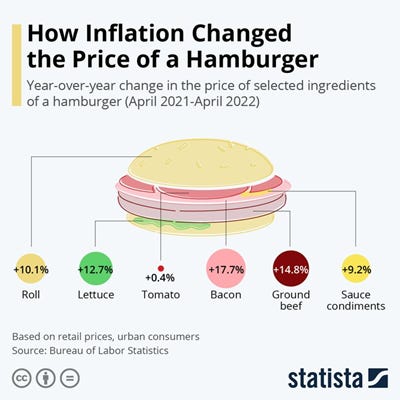

Let’s quickly take a simpler example of a hamburger – I found this cool graphic that breaks down the inflation of a single hamburger into its different parts each with different prices, but it’s sold holistically – thus, the prices of all components are integrated, the Cost of Goods Sold.

I tried to find a similar graphic for an Architecture and Construction project i.e. a property or an office and could not – the core concept is that Cost of Goods Sold includes transportation costs. If gas goes up, the cost of the product you buy goes up.

There is great risk to Architecture and Construction projects over the next year for shortages of critical supplies and commodities to occur all along the supply chain. This can come in the form of or companies ending production due to commodities being too difficult or expensive to procure. It can also come in the form of fewer choices for transportation – and thus massive delays due to the lack of availability/capacity for transport. And finally, it is certain to show up in rising prices.

I began to witness these impacts this Spring, facing 1-2 month long delays in project completion, as suppliers and producers struggle with different limitations. I have already heard of one major carpet manufacturer (to remain unnamed) whom has cut out certain products from their line, as they are now too expensive to produce, or equally difficult to receive commodities for production.

All components and transportation are prone to be impacted in costing *and* production/assembly due to rising energy costs. I expect that for projects especially going out to bid this later Fall into early next year mid Winter, we’ll see massive price increases unfold, simply due to the massive costs of energy that is required in production as well as in transport.

Keep in mind that diesel fuel in particular powers the last mile of delivery for virtually everything. Whatever it costs, it costs — and is then reflected immediately into the price on the shelf.

The Hard Data

I dug up some incredible charts and data for building materials themselves, showing the pricing shift has already begun.4

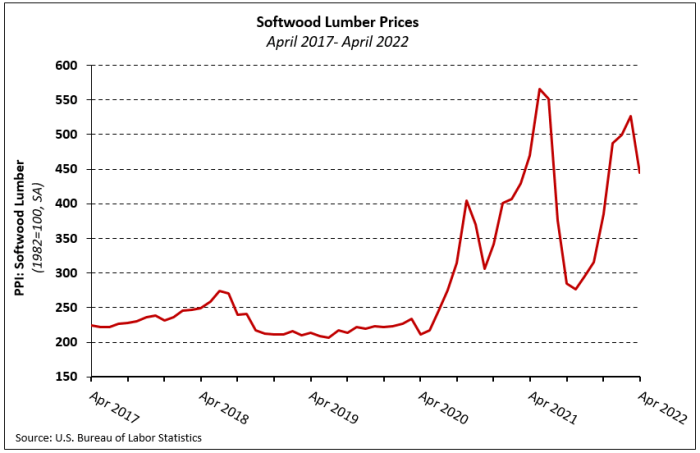

Some professionals probably remember the pandemic lumber shortage in late 2020 and early 2021; while that caused a brief spike that year followed by a decline, we’ve seen prices go right back to nearly the last peak. “The PPI for softwood lumber… is down 8.9% over the first four months of 2022. Since reaching its most recent trough in September 2021, prices have risen 60.4%.” Note also that lumber prices are incredibly volatile.

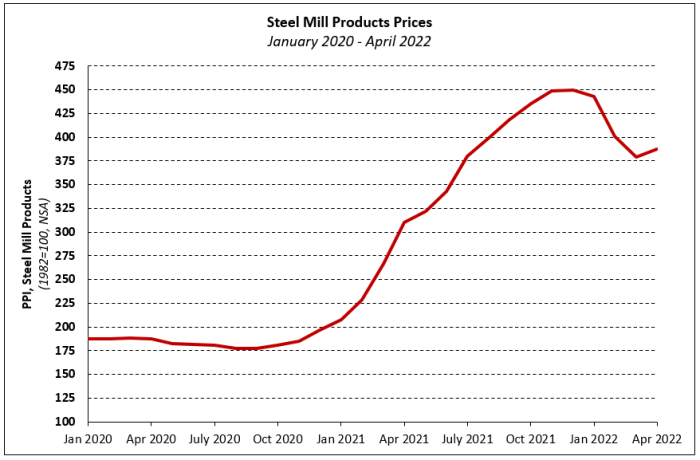

“Steel mill products prices (NSA) climbed… increasing 128.0% in 2021.” The chart does show a small drop in 2022, but is still significantly up YoY. I will note also that steel prices are quite volatile.

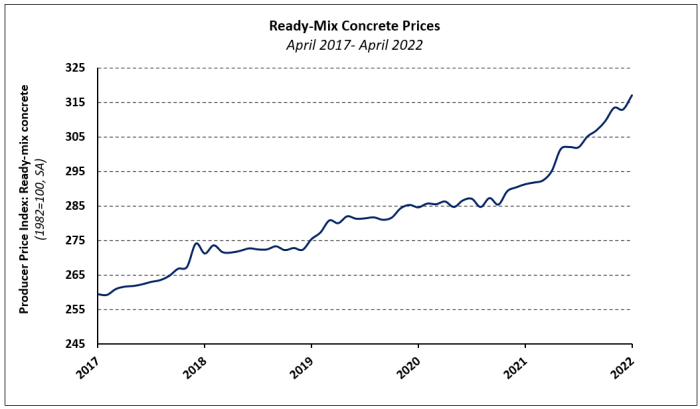

”The PPI for ready-mix concrete (RMC)…has climbed 8.9% year-over-year and is 12.6% higher than the January 2021 reading.” Ready mix concrete is used for floor slabs and flooring, core-and-shell construction, finishes, and more.

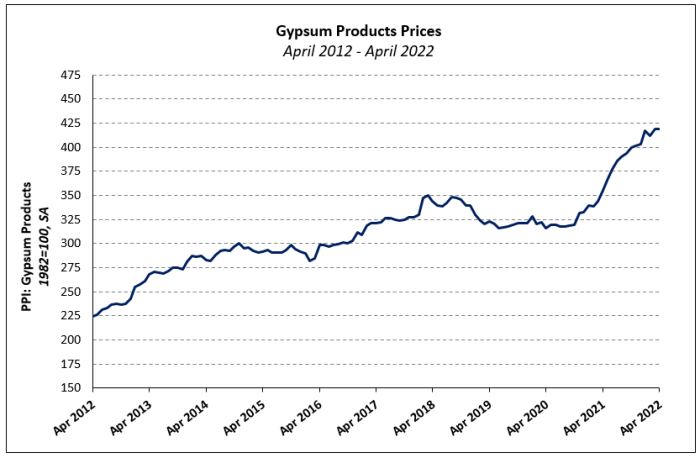

“Year-over-year, the prices of gypsum products are 17.8% higher and have increased 23.5% since January 2021.” Gypsum is most commonly found in drywall, used for walls and partitions.

Predictions Into 2023

Now I’ll share my three hypotheses for the next year, based on this data.

Hypothesis #1: Construction Materials and Transportation Costs 20-30% higher by January 2023

I do not think that fuel increases are fully priced into the construction commodities and materials market yet, but this process is ongoing with rapidly increasing costs each month. I expect that we’ll start seeing true pricing hit around September to November of this year, when the impact will start to be felt in earnest. I think also that 2023 will be a critical year for this entire cycle, when fuel shortages will be prominently witnessed during the Winter Cold Weather season, when demand for fuels is highest.

Additionally, overseas produced products, especially those coming from Europe, will see the most exorbitant price increases on the market. For example, new European stones will see immense pricing increases due to increase in production costs and shipping from abroad. The natural gas markets will emerge most pricey for European producers.

This means some higher end Architecture & Construction trades could potentially cost 20-50% more by some time next year.

Hypothesis #2: Fewer and more expensive trucking. Far higher transport and delivery costs.

More expensive fuel costs mean some operators will choose to exit the business due to lack of profitability; those that remain will charge even more, also to cover their own risks in addition to higher fuel expenses.

Some trucking firms have contracts with fixed pricing – the risk for such contracts is that high fuel costs make the trucking business uneconomic as a result of the contracts. Even if carriers have commitments, many will be forced out of business if revenue cannot cover the increased fuel expenses. If trucking firms simply can’t operate without going out of business, then they go out of business and the products don’t get delivered at all.

A recent Yahoo Finance article on the diesel fuel crisis had some interesting comments from the EVP of the Owner-Operator Independent Drivers Association, a trucking association.5

Some of the 350,000 registered owner-operator drivers seek the protection of company driving, or lease their independent services to a fleet…

”It’s not happening yet, but it’s coming,” said William “Lewie” Pugh, an OOIDA executive vice president who worked as a leased owner-operator for 24 years, said of free-agent independent drivers either leaving the business or deciding to change the way they operate.”

This ultimately means consolidated and far fewer choices in trucking – less competition means higher rates, along with the high fuel costs.

Hypothesis #3: Longer Term Demand Destruction

As long as this trend continues – unfortunately, I must say I see every reason for it to get far worse – we will again ultimately witness stagflationary cycles – ultimately, unprecedented and severe demand destruction, due to the incredible costs associated with construction projects.

Because project budgets are fixed and don’t increase with inflation nor with rising fuel cost, this means the only way financiers can compensate is by equalizing for scope. Projects will see more funding diverted to transportation and fuel costs over scope and finished product. I think we’ll also witness a move to simpler projects to compensate. Owners will shy away from scope deemed too expensive, which will hurt us long term.

Now, does this mean bad news for the industry?

On the contrary, these conditions have created sky high demand in the present moment – I suggest professionals use this opportunity to take on as much work as possible before the market recedes in 2022 and 2023, while also using ample opportunity to make oneself useful to projects.

Here’s Four Tips to Handle the Fuel Crisis On Projects:

- Stay proactive and well ahead of the curve for your orders and inventory placements.

- Advise your contractor to consolidate deliveries as much as possible. In this environment it’s better to have fewer deliveries and having them consolidated.

- Such conditions are also ripe for back-up deliveries – in other words, set up back-up truck, rail, and air transport as much as possible.

- Set up second and third freight delivery days as back-ups in the weeks following an original planned delivery date – in case a delivery period gets delayed and you need to reschedule. We recently had this happen on a project, and in the end we were scrambling to reschedule freight elevators.

The demand for professionals in building and managing such Architecture and Construction projects will stay strong at least through late 2022 and early 2023. We will gradually move towards a recession and slow-down in workflow into 2023 – demand destruction is a very real risk due to rising prices and the multitudes of challenges facing actually completing projects properly.

- 1. https://www.statista.com/statistics/1046602/inflation-construction-materials-us/

- 2. https://markets.businessinsider.com/news/commodities/diesel-supply-crisis-record-price-white-house-gas-emergency-reserves-2022-5?op=1

- 3. https://markets.businessinsider.com/news/commodities/natural-gas-prices-tripled-diesel-oil-2021-almost-no-ceiling-2022-5

- 4. https://eyeonhousing.org/2022/05/building-materials-prices-move-higher-up-19-year-over-year/

- 5. https://finance.yahoo.com/news/truckers-facing-existential-crisis-fuel-180000984.html

Table Of Contents

Table Of Contents

Leave a Reply